Cars allow people to get from one place to another quickly since they no longer need to wait for a bus, jeep, or taxi in Cubao. Car owners enjoyed the benefits of owning vehicles during the lockdown period when public transport was unavailable for commuters. Many Filipinos struggled to get their groceries during the Enhanced Community Quarantine period, and they might consider getting one in the future. However, many people only get a car without insuring them.

Many Filipinos are superstitious and think that getting insurance invites trouble and increases the chances of going through an auto accident. Many people also see insurance plans as only an additional expense that they don’t need as long as they’re careful. The only problem is that there are plenty of uninsured irresponsible drivers on the road that can cause accidents that even careful drivers can’t avoid.

Cubao residents need affordable car insurance Cubao to protect themselves from the costs of accidents and property losses. Getting insured means spending money on a plan to protect car owners’ finances when their vehicles are lost or receive significant damages. People don’t have to worry about spending too much on insurance plans when they know how to get affordable ones.

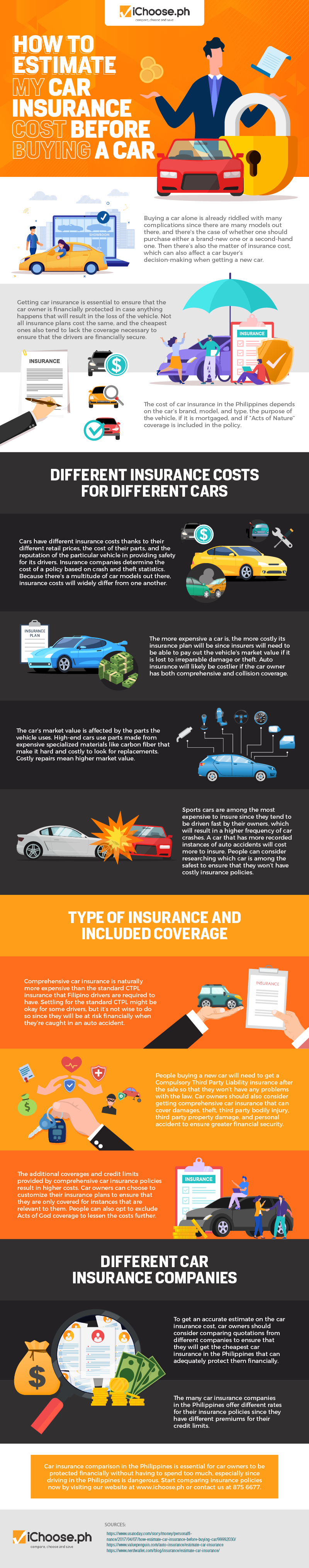

People can estimate how much they’ll pay for insurance plans by considering the vehicle’s market value. Expensive cars have costly spare parts that lead to pricy repair jobs, which means that the car owner has to pay higher premiums. The cheaper the car is, the lower the insurance cost. The vehicle’s reputation also affects the insurance plan’s price.

The cost of insurance plans also differs depending on the number of inclusions in the specific plan. The basic and mandatory CTPL or Compulsory Third Party Liability insurance is the cheapest insurance plan thanks to their limited coverage focusing only on liability. A comprehensive car insurance plan is more expensive than CTPL insurance Philippines since they cover more, including liability, third party property damage, own damage, personal damage, and theft. Car owners can also include Acts of Nature coverage to protect their cars from tropical storms.

The price of car insurance plans also varies per insurance company. Car owners can get an affordable policy that can protect their vehicles from relevant risks by comparing car insurance plans.

Car owners no longer need to worry about having to spend so much money on insurance once they estimate the cost even before buying a car. For more information, see this infographic by iChoose.ph.